9% Refund

Only with Tax Free

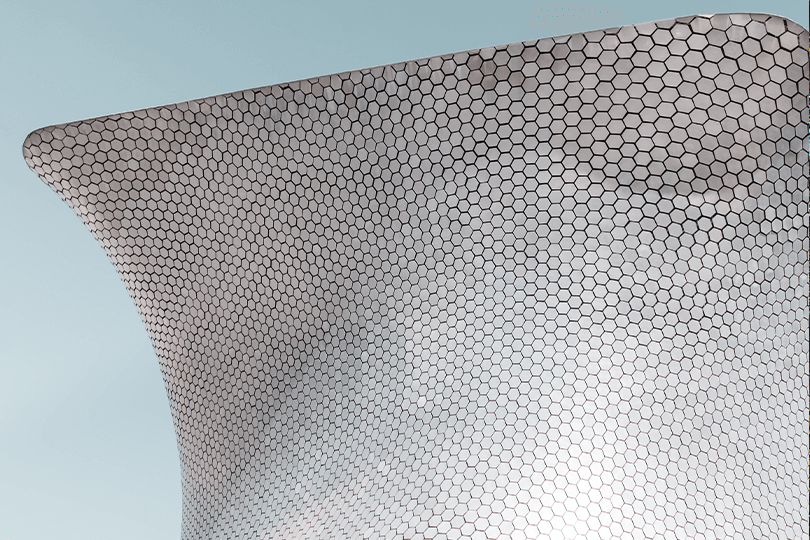

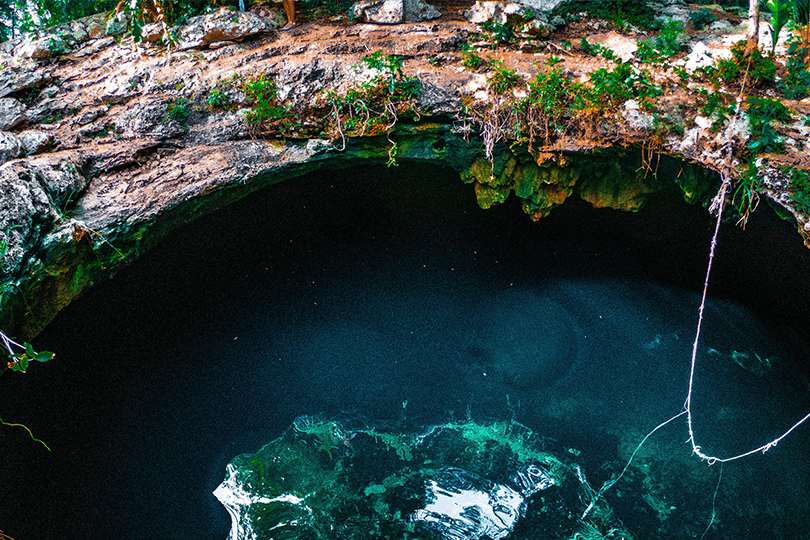

Shop in Mexico and save money in taxes!

Master Tips!

What do I need for my return?

Travel Documents

Take pictures of:

- Passport

- Migration form

- Boarding pass or cuise card

Purchase Documents

Upload documents:

- Receipt

- Voucher (if pay by card)

- Invoice

- Front of payment card(s)

Invoice

Ask for a generic invoice for tourist with the following information:

- Your nationality

- Full name

- Passport number

- Generic RFC: XEXX010101000

Money Limits!

- Minimum purchase $1,200 MXN in any form of payment without a maximum limit when buying with a credit or debit card.

- Cash purchase refunds cannot exceed $3,000 MXN per person.

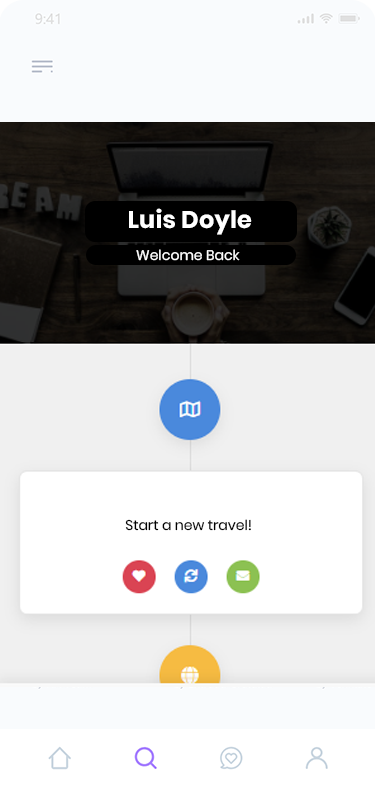

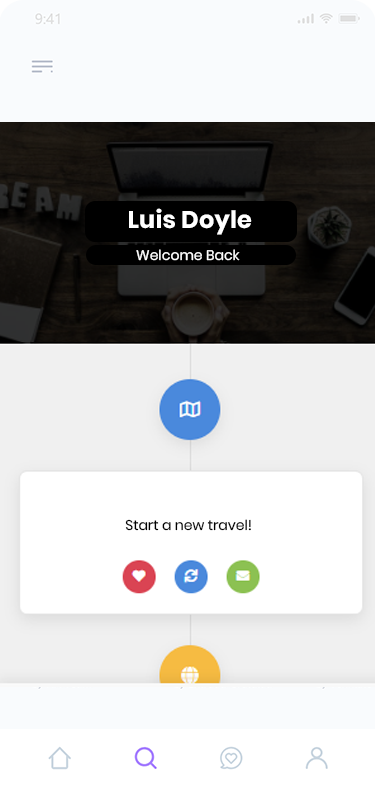

Steps to refund success

-

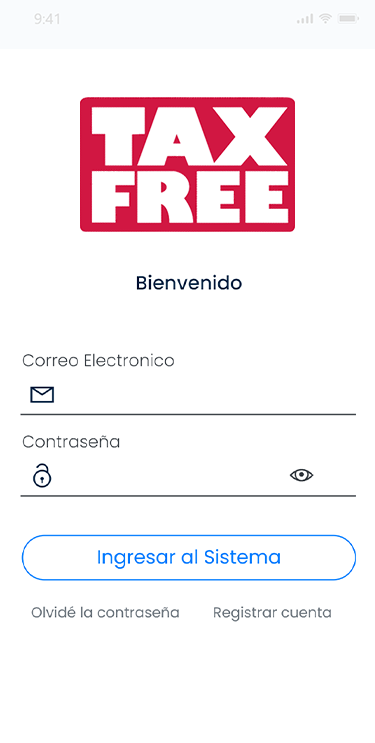

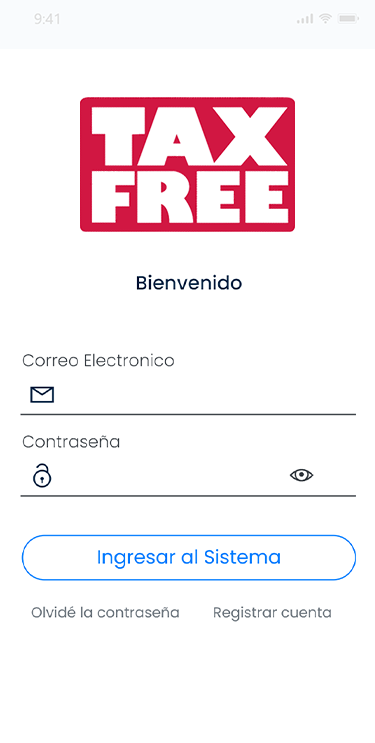

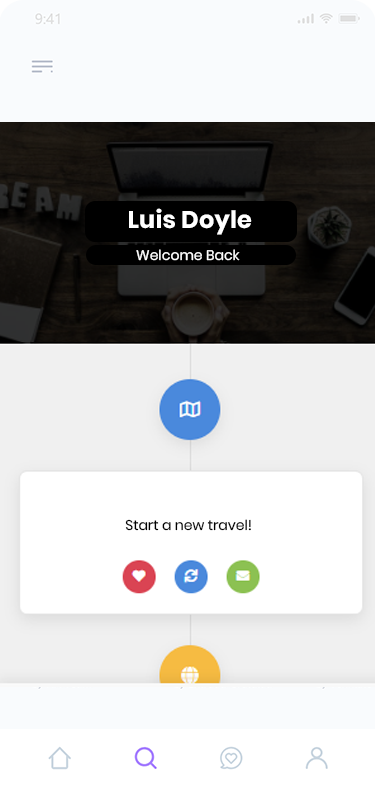

1. Create your profile!

Signup, complete your profile and start getting discounts of 9% on all your trips.

-

2. Register a new trip!

Through our platform upload your documents such as: passport, boarding ir cruise pass and migration form

-

3. Let´s go shopping!

Make your purchases in all the stores and brands that are our partners!

-

4. Register purchases

Use our platform to submit a tax refund for all your purchases, by uploading receipts, vouchers and invoices.

-

5. Get your refund!

Wait to get your tax back, you will be able to track your refund from your account in the platform.

Start saving now!

Get an 9% discount!

You do not have to wait! Get reimbursed for the purchases you made during your visit to Mexico. Use our digital platform to receive support and follow up.

Real time activity

Track the status of your process in real time!

Progressive Web Application

Works from any device and anywhere in the world!

Simple & Fast

The simplest and fastest way to get your refund!

Millions of refunded purchases

Since 2006, many happy customers around the world trust our service

+ 575,000

Clientes

+ 15 Years

Experience

+ 1000

Partners

Do you have questions?

Are you not sure about some terms or how to carry out your tax refund process for purchases made in Mexico?

Here are the answers to some of the most common questions we hear from our appreciated customers

The refund time depends on how quickly we can approve your submission.

We are required to submit all documentation to the Mexican government for approval of the tax return process. This means that we need personal information such as passport, boarding or cruise pass, migration forms along with invoices, receipts and vouchers for all purchases.

Once we receive all your documentation we carry out a rigorous evaluation process. If we find something missing or out of place, We will let you know when validating your purchases.

Once the process has been approved and your tax refund is underway, you can wait a period of 40 business days.

If you have additional questions, do not hesitate to contact our support center at info@taxfree.com.mx

A series of documents are required to validate your purchases in Mexico.

Our system is designed to easily upload photos and files of the required documents.

The necessary documents are:

- Passport: upload the pages where your signature and photo appear, making sure the passport number and validation dates are legible. For returning users, you will be able to use a previously uploaded passport photo, as long as the document is still valid.

- Boarding or cruise pass: The boarding pass or the cruise card and itinerary are documents that can make our validation process fast and simple.

- Migration form: a small green piece of paper that the immigration authorities give you upon arrival, as long as you have arrived to Mexico by air. Please make sure the tourist box is checked.

- Cash purchases must be verified with a receipt and an invoice.

- Purchases with a credit or debit card must be verified with a receipt, an invoice and a voucher.

Invoices must be uploaded as XML digital files provided by each store.

Please make sure you upload good quality photos and include all pertinent information.

Our team will have to review each document to validate your refund. You will be notified if something is changed or corrected, this could affect the time it takes to approve your refund.

All documents are important.

By law, we are required to provide all three documents for each purchase depending on the payment method.

Here we explain the differences between them:

- Receipt: is a bill of sale that details each of the items purchased. This is usually printed by the store and reveals each item in the checkout. It contains the price of each item, the total amount of the purchase, the store that makes the sale and the date of purchase.

- Voucher: is a document that is only generated when the purchase method involves one or more credit or debit cards. This is printed by the payment terminal or point of sale when you swipe your card to complete the transaction.

- Invoice, you must ask the store for this document during the purchase. Must contain specific information about you. Remember to request that the following details be included:

- Your full name as it appears on your passport

- Your passport number

- Your country of origin or nationality

- The following RFC code: "XEXX010101000" (Known as "Generic RFC")

If you have any problems getting the invoice, feel free to contact us for assistance at info@taxfree.com.mx.

There is no upper limit on how much you can claim back.

However, there is a minimum of $1,200.00 MXN for each purchase.

Additionally, the government will only reimburse the first $3,000.00 MXN spent in cash per person.

There is no upper limit for the amount spent by credit or debit cards.